As of January 1st, Waterman-Neely is now partners with AAdvantage Insurance Group. You will be referred to our main site in 10 seconds...

-

Address: 110 W Walnut St, Chatham, IL 62629

-

Phone: (217) 483-2441

-

Email: info@aadins.com

-

Fax: 217-207-0118

-

Text: 618-692-4440

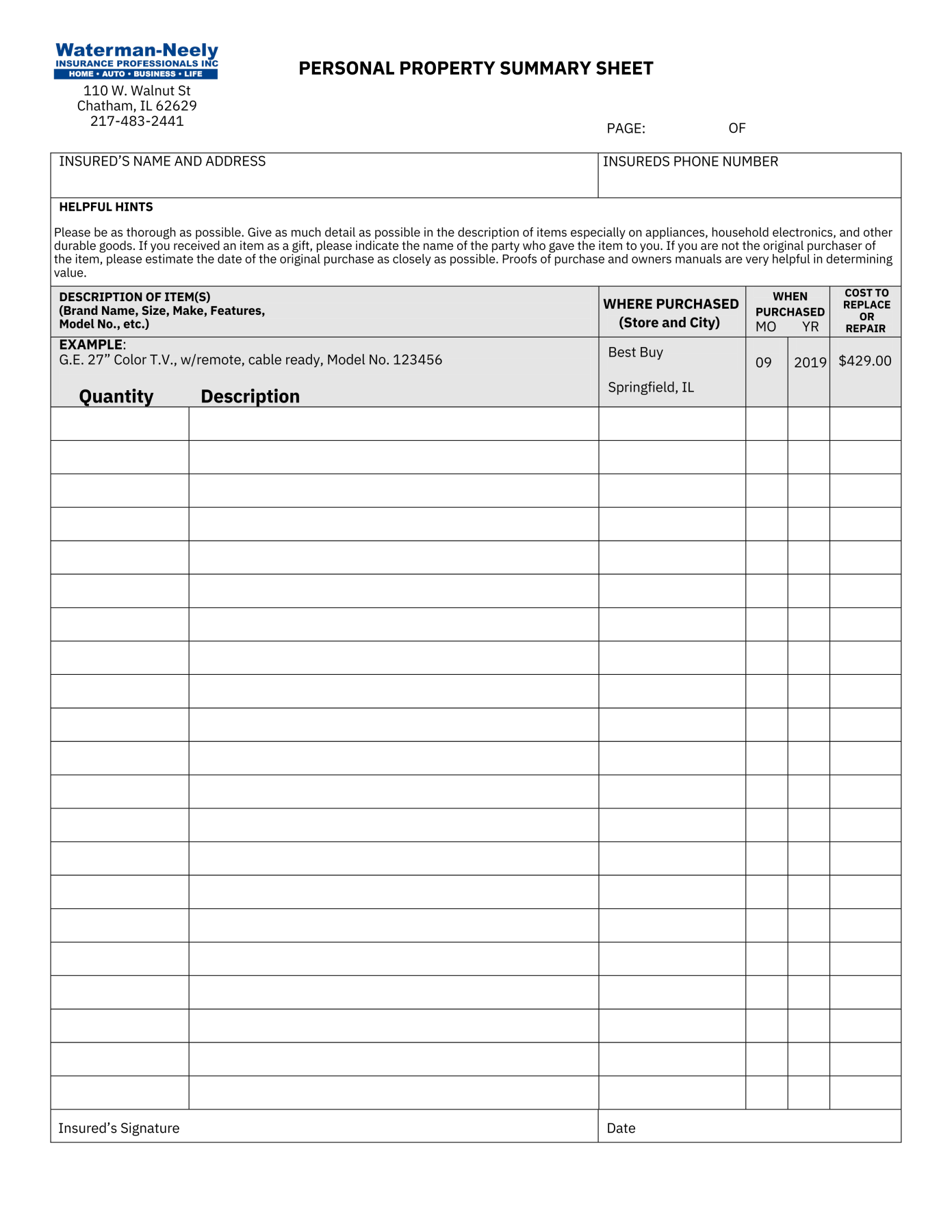

Businesses don’t have to be the only ones that use an inventory list. You can use one for your home as well! Having a personal property inventory list can be very important for several reasons, including:

- Insurance Claims: In case of theft, natural disaster, or other events that may result in the loss or damage of your property, having an accurate inventory list will help you file a claim with your insurance company more efficiently. It will also help you to establish the value of the items lost or damaged and expedite the settlement of your claim.

- Estate Planning: A personal property inventory list can also be helpful for estate planning. It can help ensure that your assets are distributed according to your wishes and that nothing is overlooked or forgotten.

- Moving: If you’re moving to a new location, it can be helpful to have an inventory list to keep track of what items you have and their condition. This can help you to avoid losing or damaging items during the move.

- Organization: Maintaining an inventory list can help you stay organized and keep track of your possessions. It can help you identify items that may be missing or stolen, and it can also help you to decide what items you no longer need or want.

Overall, a personal property inventory list is a useful tool for protecting your assets, planning your estate, and staying organized. You are more than welcome to download the one we made to help you get started! Just hit the link or the download button below this image!

Here are more articles your might be interested in:

- Whole Vs. Term Life Insurance

- Enjoying Safe and Healthy Use of Social Media

- Tips for Preventing House Fires

- Fuel-Saving Tips: Unlocking Efficiency and Stretching Your Gas Mileage

- Why You Need a Personal Property Inventory List